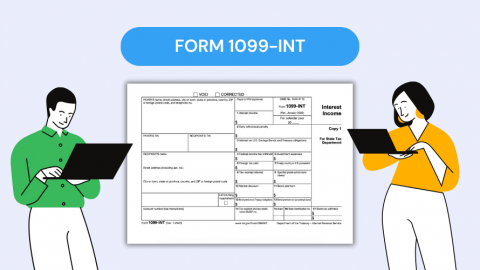

1099-INT Tax Form

When tax season arrives, an array of forms and documents must be navigated, and among these documents is the IRS tax form 1099-INT. This particular form plays a crucial role in reporting income earned from interest during the year. Careful attention to detail is required when filling out this form to ensure accuracy in your tax return. To assist you through the process, let's explore the essentials of the 1099-INT tax form for 2023 and its various components.

Objective of the 1099-INT Tax Return Form

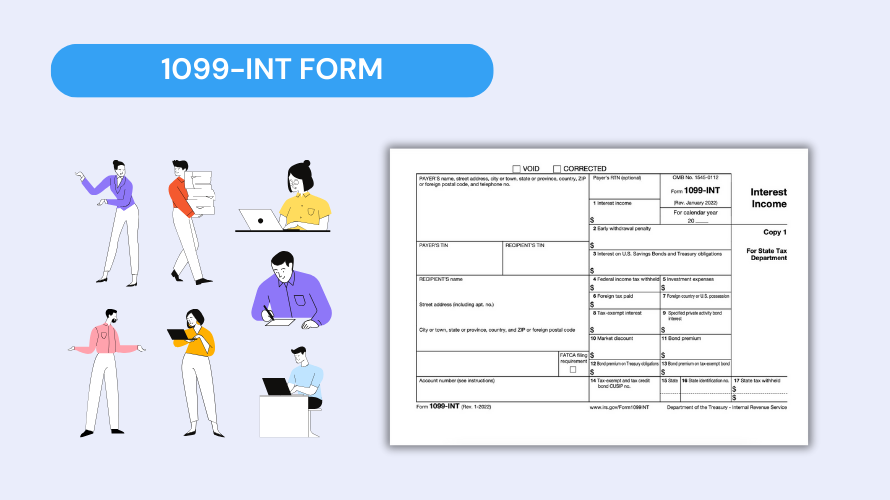

The premise behind the 1099-INT form is relatively straightforward. It is a document that financial institutions are required to issue to investors who have earned a certain amount of interest income during the fiscal year. The form is then used by taxpayers to report this information on their annual tax return 1099-INT income should be included on your return because interest earned is taxable income according to the Internal Revenue Service.

Filing Tax Form 1099-INT: Important Aspects

It is important to remember certain key points when preparing to include your 1099-INT information on your tax return. Here are bullet-point reminders to keep in mind:

- Verify the accuracy of your personal information, including your name and Social Security number.

- Ensure that the total interest income reported matches your records and reconcile any discrepancies.

- Remember that interest income must be reported even if no tax was withheld.

- Account for any interest from foreign accounts; additional reporting requirements may apply.

- Double-check the form for exempt-interest dividends from mutual funds, as these should be reported on your tax return as well.

Adhering to these reminders will facilitate a smoother process when incorporating your 1099-INT data into your overall tax situation.

Common Errors in Tax Form 1099-INT

Even with care and attention, mistakes can happen when dealing with the 1099-INT tax return. Awareness of typical errors may help you prevent them:

- Failing to report all interest income because the amounts seem too small to matter; every penny counts when it comes to the IRS.

- Mixing up tax-exempt and taxable interest amounts can lead to reporting errors.

- Overlooking to include the form with your tax return if the interest was subject to backup withholding.

- Forgetting to update personal information, which could result in your form being sent to the wrong address.

To avoid these common errors with your 2023 1099-INT tax form, several strategies can be employed. First and foremost, keep a detailed record of all the interest income you receive. Utilize a checklist to ensure no source of income is forgotten. Regularly update your personal information with financial institutions to ensure you receive all necessary forms. Consulting with a tax professional is advisable if you have any doubts or require clarification. They can provide tailored assistance regarding your unique tax situation.

Latest News