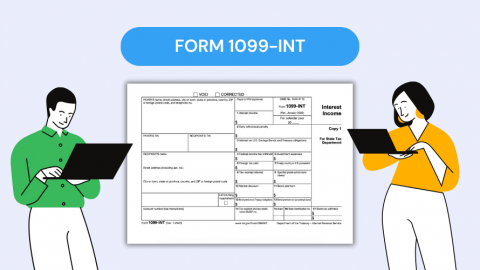

Printable 1099-INT Form

Navigating through the intricacies of tax forms can be a challenging endeavor. The IRS 1099-INT tax form printable is no exception, but understanding its structure is integral to accurately reporting your interest income. This document is designed to report income from interest, and it is a document that financial institutions use to report the interest they have paid to investors over the course of the tax year. It consists of several key fields that must be completed by the payer.

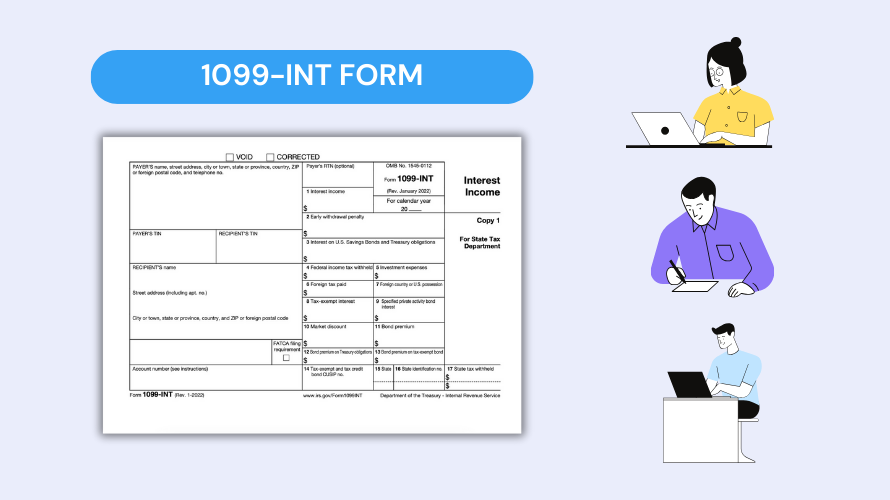

The Structure of the 1099-INT Template

The primary box to note is Box 1, labeled "Interest Income," which captures the total interest paid during the year. Another important segment is Box 3, "Interest on U.S. Savings Bonds and Treasury Obligations," which records interest from government-issued securities. Boxes 4 and 8 concern themselves with federal and state tax withheld, respectively, and are vital for those who have had taxes withheld from their interest income.

Printable 1099-INT Form: Completing Guideline

- Verify the accuracy of all personal information, such as taxpayer identification numbers and addresses.

- Record the correct total of interest income in Box 1 without including any penalty charges for early savings withdrawal.

- If applicable, accurately document the amount of interest from U.S. Savings Bonds and Treasury Obligations in Box 3.

- Include any federal tax withheld in Box 4 to ensure credit for any tax payments already made.

- Carefully report any state tax withheld in Box 8, which could affect state tax returns.

- Ensure all other applicable boxes of the printable 1099-INT form for 2023 are filled out correctly, including foreign tax paid and specified private activity bond interest.

Steps to Fill Out the 1099-INT Blank Form

Filing your printable 2023 1099-INT form need not be a cumbersome task. With methodical steps, you can ensure that your filing process is both smooth and error-free.

- Begin by obtaining the printable 1099-INT form from the IRS website or a financial institution issuing the interest.

- Fill in all the necessary details per the guidelines above, double-checking each entry for accuracy.

- Copy the relevant information onto other copies of the form as required since the IRS requires one copy while another may be needed for state tax purposes.

- After completion, send Copy A to the IRS before the filing deadline. For electronic filings, ensure you follow the IRS's requirements for digital submissions.

- Distribute the other printable IRS Form 1099-INT copies to the recipient of the interest income or to the state tax department if applicable.

- Keep a copy for your records for future inquiries or tax audits.

File Tax Form 1099-INT on Time

The punctuality of submitting tax documents is paramount to remain in compliance with the IRS. For the printable tax form 1099-INT, the deadline for furnishing Copy B to the recipient is typically January 31st, following the tax year in which the interest income was paid. The deadline for submitting Copy A to the IRS usually falls on February 28th if you are filing on paper or March 31st if you are filing electronically. Staying ahead of these dates is crucial to avoid potential late submission penalties.

Latest News