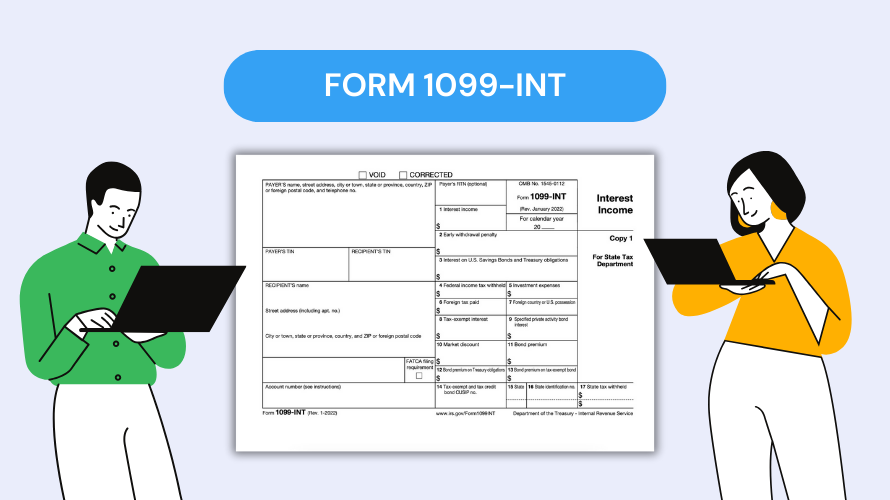

IRS Form 1099-INT (Interest Income)

The genesis of what is commonly referred to as IRS Form 1099-INT (Interest Income) lies in the broader context of the Income Tax Regulations under the United States Department of the Treasury. Initially established to create transparency and accuracy in the reporting of earnings through interest, IRS Form 1099-INT has remained a vital component of the tax reporting system for many years. Its primary purpose has been to apprise the Internal Revenue Service and the taxpayer of the amount of interest income received during a tax year, thus ensuring proper taxation in accordance with federal law.

IRS Form 1099-INT: Recent Amendments

In keeping with technological progression and the ever-evolving nature of tax laws, the IRS has introduced several modifications to the 1099-INT interest income form. These changes are geared towards simplifying the reporting process for both payers and recipients and to better capture the nuances of various types of interest income. Instructions accompanying the form are regularly updated to reflect these alterations; hence, taxpayers are encouraged to review the latest versions of the instructions to ensure compliance with current tax regulations.

Criteria for Reporting on IRS Form 1099-INT

Eligibility for using the 1099 interest income tax form is distinctly outlined by the IRS. Financial institutions, for instance, are mandated to issue a 1099-INT to any individual who has accrued at least $10 in interest income within a fiscal year. This includes:

- interest from bank accounts,

- savings and loan associations,

- credit unions,

- investments like certificates of deposit.

Conversely, individuals are not qualified to utilize the form as issuers; this responsibility is strictly designated to the entities that disburse the interest income.

1099 Interest Income Form: Ineligible Parties & Exceptions

There are instances, however, where entities are exempted from issuing the interest income 1099-INT to the IRS, such as when interest payments to any one recipient total less than the specified minimum threshold of $10. Another interesting point to consider is the fact that tax-exempt interest, while reportable, may not necessarily result in tax liability but must still be disclosed on IRS Form 1099-INT. Therefore, taxpayers must understand the unique circumstances of their interest income to report and comply with IRS guidelines accurately.

IRS 1099-INT Form: Key Takeaways

To optimize the benefits of the 1099 interest income statement form, individuals should maintain meticulous financial records throughout the year. By doing so, one can effortlessly cross-reference their own records with the information reported on the Form 1099-INT. This practice minimizes the likelihood of discrepancies, which could lead to audits or penalties. Additionally, understanding the implications of potential deductions associated with interest expenses can offset the reported interest income, thereby optimizing the taxpayer's overall financial strategy.

Latest News