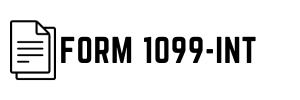

1099-INT Fillable Form

IRS Tax Form 1099-INT: A Guide for First-Time Filers

In the intricate landscape of United States taxation, the 1099-INT for interest income reporting is pivotal. It is the document financial institutions use to report interest income paid to individuals exceeding $10 annually. Taxpayers, in turn, utilize the information provided on this form to accurately declare any interest income received during the fiscal year on their annual returns, ensuring compliance with federal tax regulations.

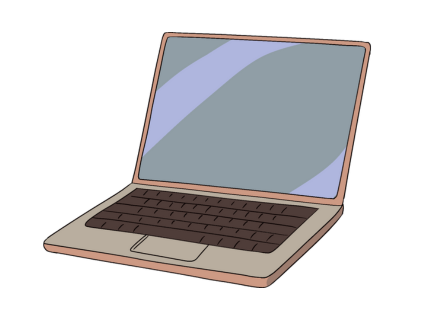

Navigating the complexities of tax documentation can be daunting, even for the most meticulous individuals. Fortunately, our website, 1099int-form-fillable.net, is a valuable resource for those needing assistance. With an accessible free 1099-INT template, our online platform offers comprehensive instructions and illustrative examples. The guidance provided not only simplifies the process of correctly completing fillable 1099-INT for 2023 but also instills confidence in the user that their interest income reporting will be executed precisely.

IRS 1099 Form: Obligated Taxpayers & Primary Demands

Individuals and entities that have paid at least $10 in interest to another party during the tax year must file the 1099-INT form with the Internal Revenue Service. This form is critical to the tax filing process, reporting interest income from bank accounts, savings plans, and other financial securities. As such, entities ranging from banks to individuals who act in a lender capacity are compelled by U.S. tax law to disseminate this information.

A person may need both the 1099-INT and the 1099-MISC forms at the same time due to their financial activities or income sources within a tax year. The 1099-MISC form is used to report various types of income that are not wages, salaries, or tips (these are reported on a W-2 by employers). It's particularly relevant for freelancers, independent contractors, or people who are part of the gig economy. Find more instructions at the 1099misc-form-online.com website.

Explaining Form 1099-INT With Example

Consider the case of Eleanor Rigby, a retiree who, after a long career in education, took to prudent financial planning by investing in a diversified portfolio of bonds and certificates of deposit. The yield from these investments exceeded the stipulated threshold, obliging her to fill out the 1099-INT form. Her meticulous record-keeping and attention to detail ensure that Eleanor accurately reports her interest earnings, thus adhering to the tax codes.

Should Eleanor decide to manage her tax documents digitally, she can utilize the 2023 1099-INT in PDF fillable format to streamline the process. This simplifies preparation and enables her to file the 1099-INT electronically, complying with the IRS's regulations while embodying efficiency and environmental stewardship by reducing paper usage. Eleanor's embrace of technology reflects a modern approach to a task as timeless as tax reporting.

Simple Guide to Fill Out the 1099-INT Form in PDF Online

Understanding the intricacies of tax documentation is imperative for precision and compliance with the IRS regulations. The 1099-INT form specifically caters to individuals who must report interest income earned during the tax year. To ensure accurate reporting, one must follow these structured steps.

Due Date to File 1099-INT

For those taxpayers engaging in electronic submission, the e-file 1099-INT process provides a streamlined approach for reporting interest income during the tax year. It is crucial to note that the due date for filing this form is typically April 15 of the year following the reported tax year. Compliance with this deadline is paramount, as failure to submit the 1099-INT fillable form for 2023 on time can result in penalties.

The 1099-INT Form-Related Fines From the IRS

The Internal Revenue Service (IRS) may impose fines for late submissions or for inaccuracies on the forms, which may include deliberately providing false information. These monetary penalties increase progressively with the delay in filing, and the severity of the misinformation reported can significantly impact the gravity of the penalties. It is in the best interest of the taxpayer to ensure punctuality and accuracy in all tax-related matters.

IRS Form 1099-INT for 2023: Questions & Answers

Federal Tax Form 1099-INT: More Instructions & Examples

Please Note

This website (1099int-form-fillable.net) is an independent platform dedicated to providing information and resources specifically about the 1099-INT fillable form, and it is not associated with the official creators, developers, or representatives of the form or its related services.